Overview

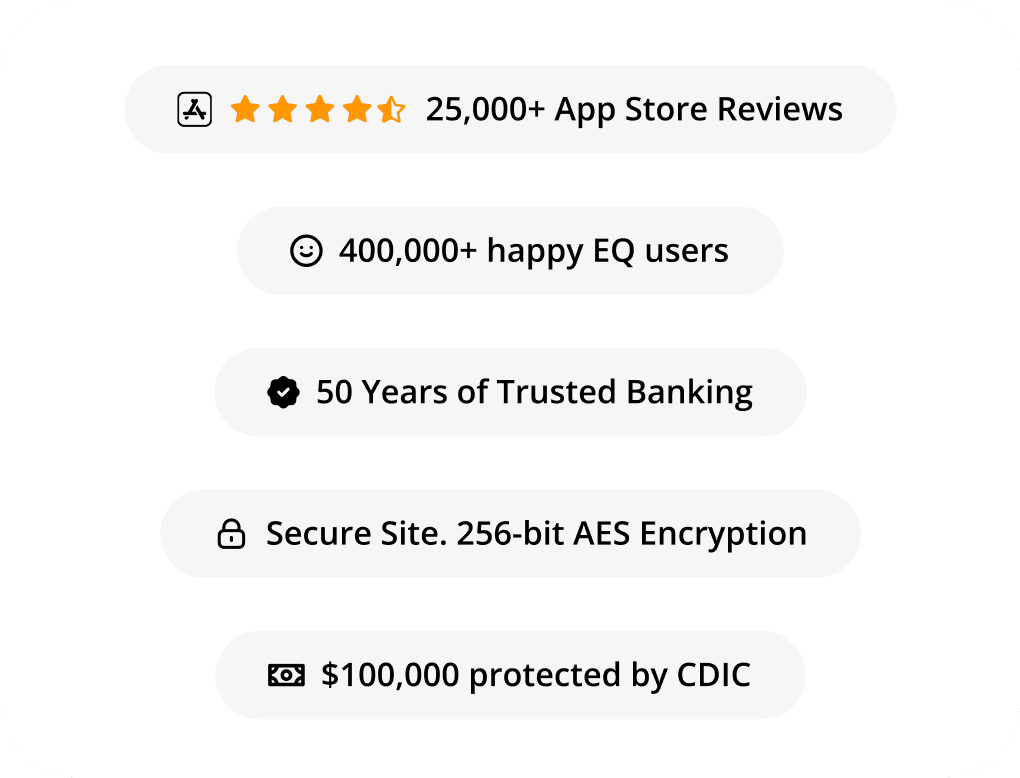

EQ Bank is Canada’s largest challenger bank, serving 640,000 users with $74 billion in assets. I led the product design for EQ Bank’s Business Banking platform, introducing innovations that redefined Canadian banking, improved user experience, aligned with strategic business goals, and drove revenue growth.

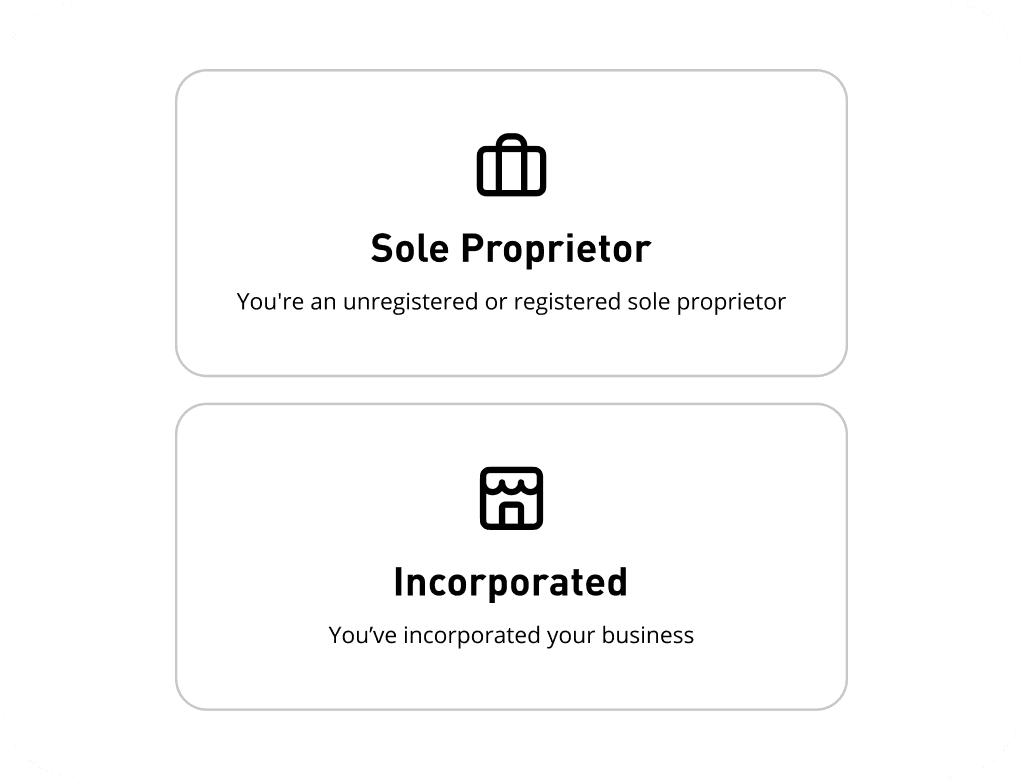

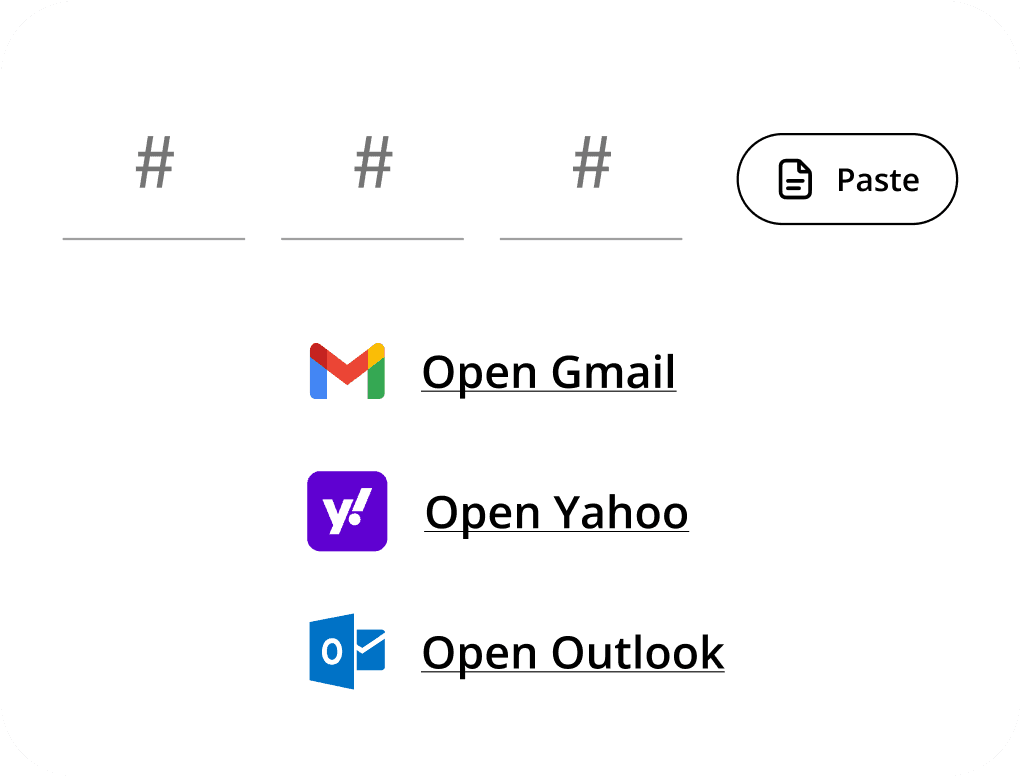

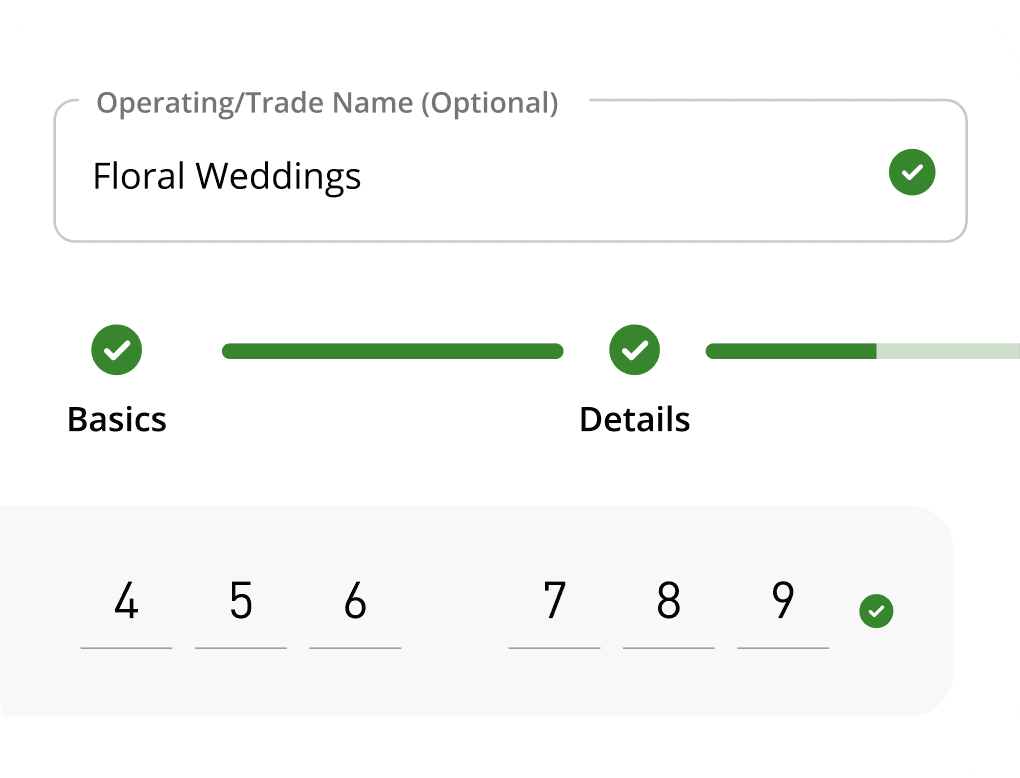

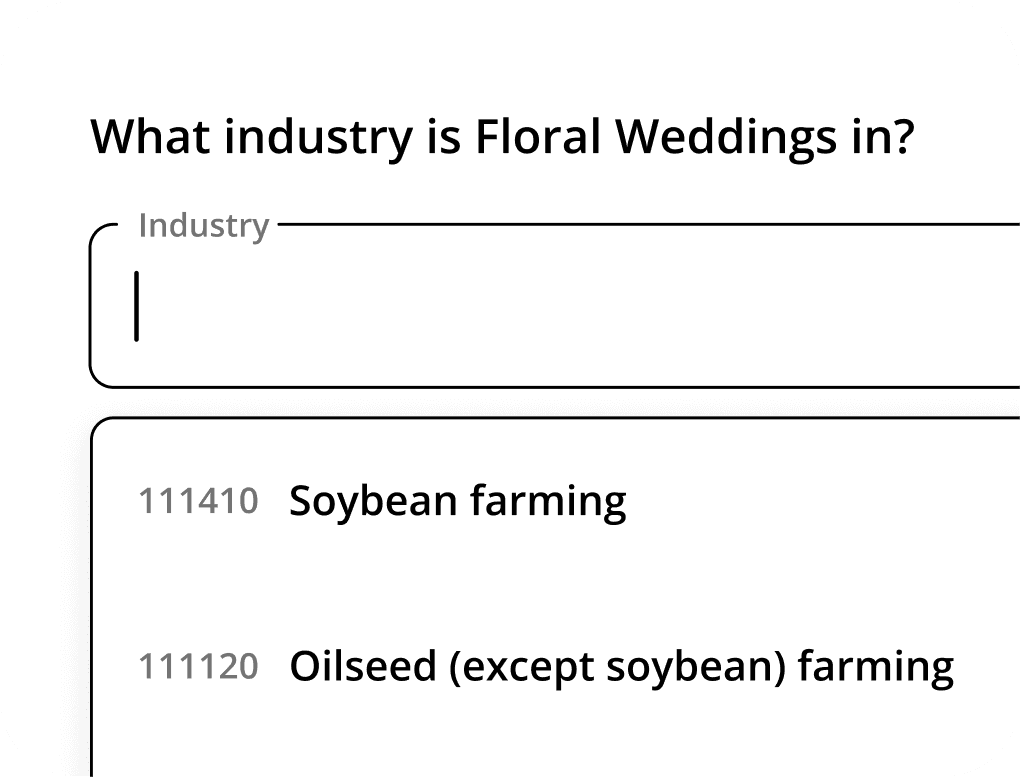

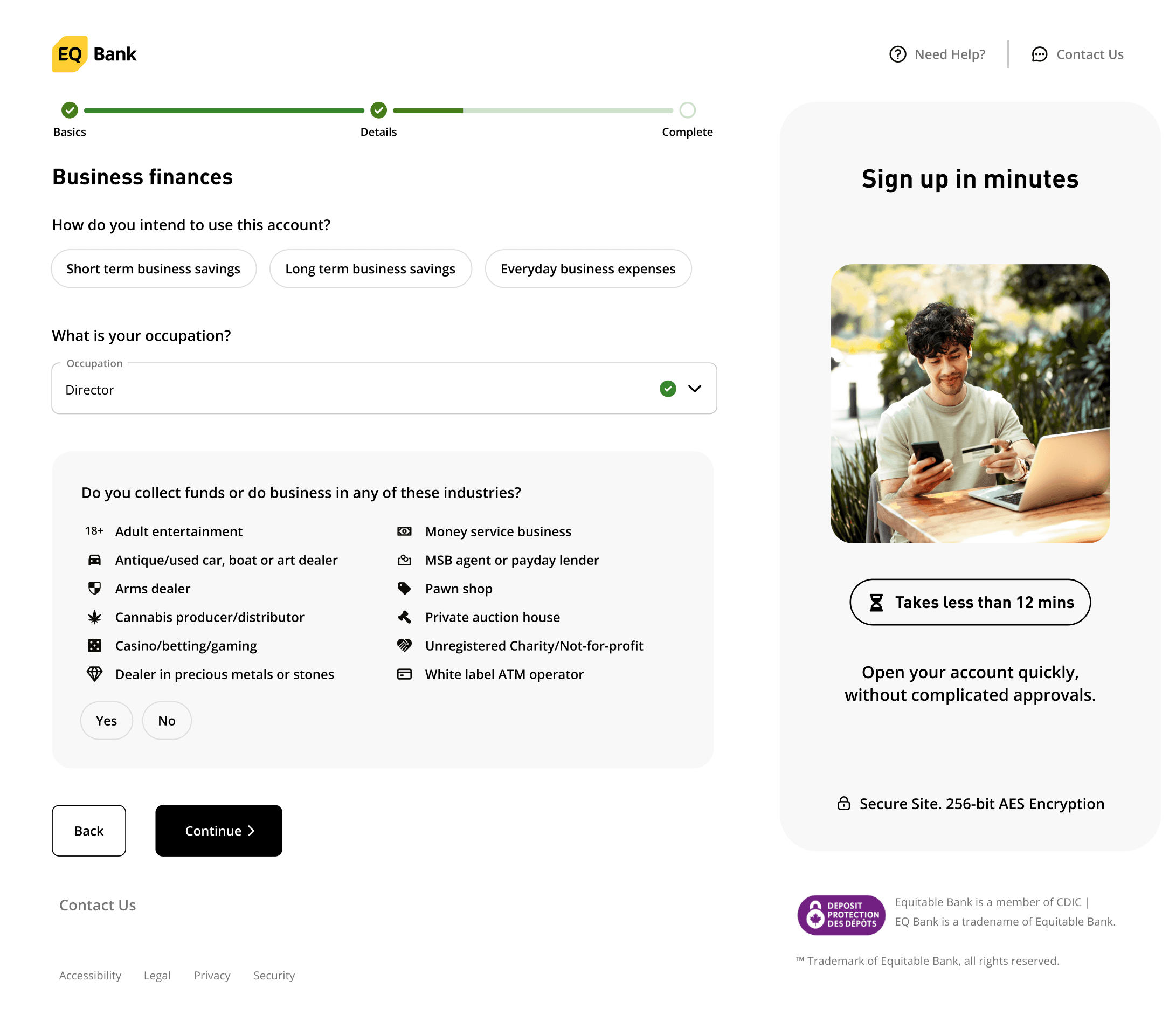

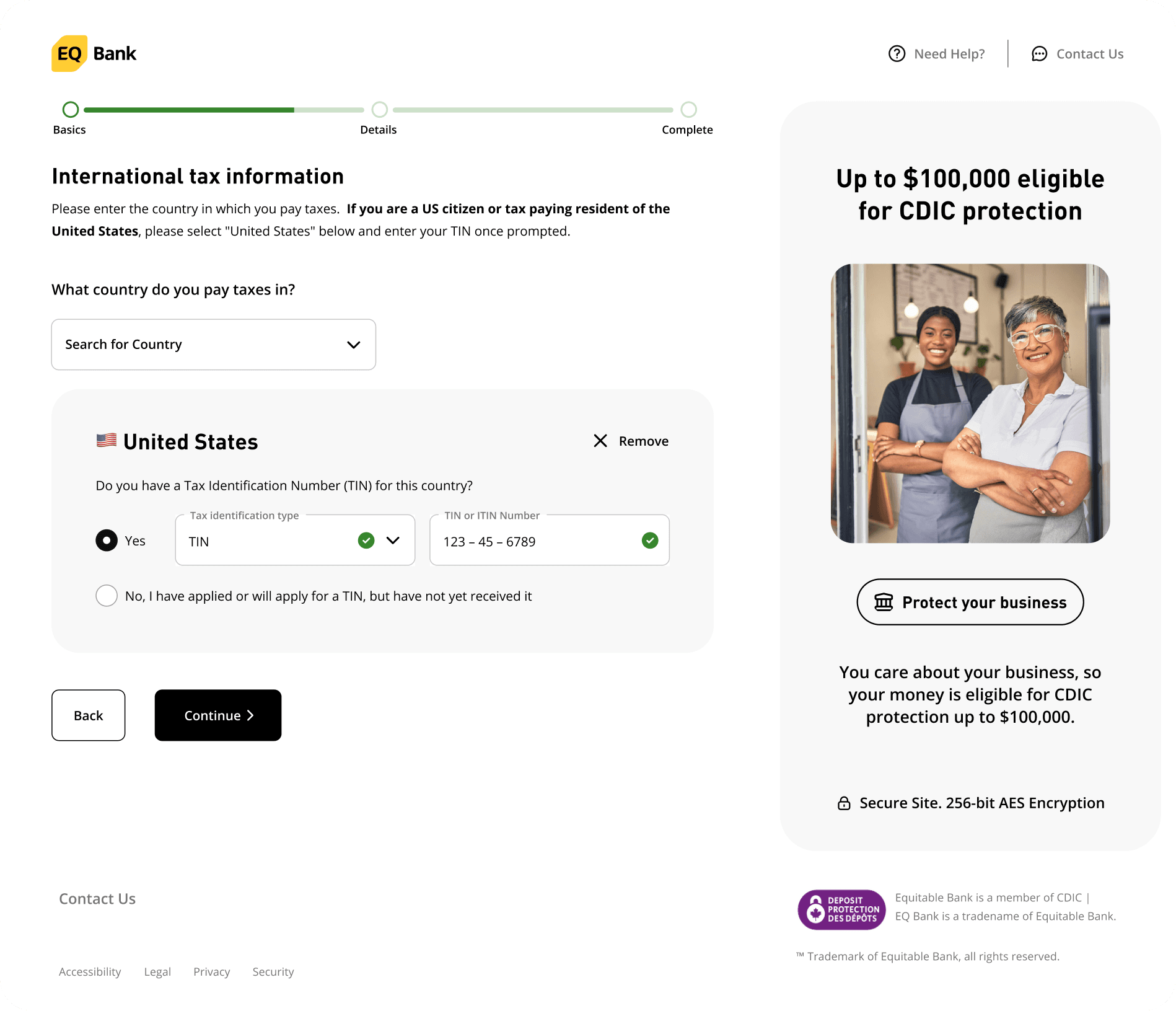

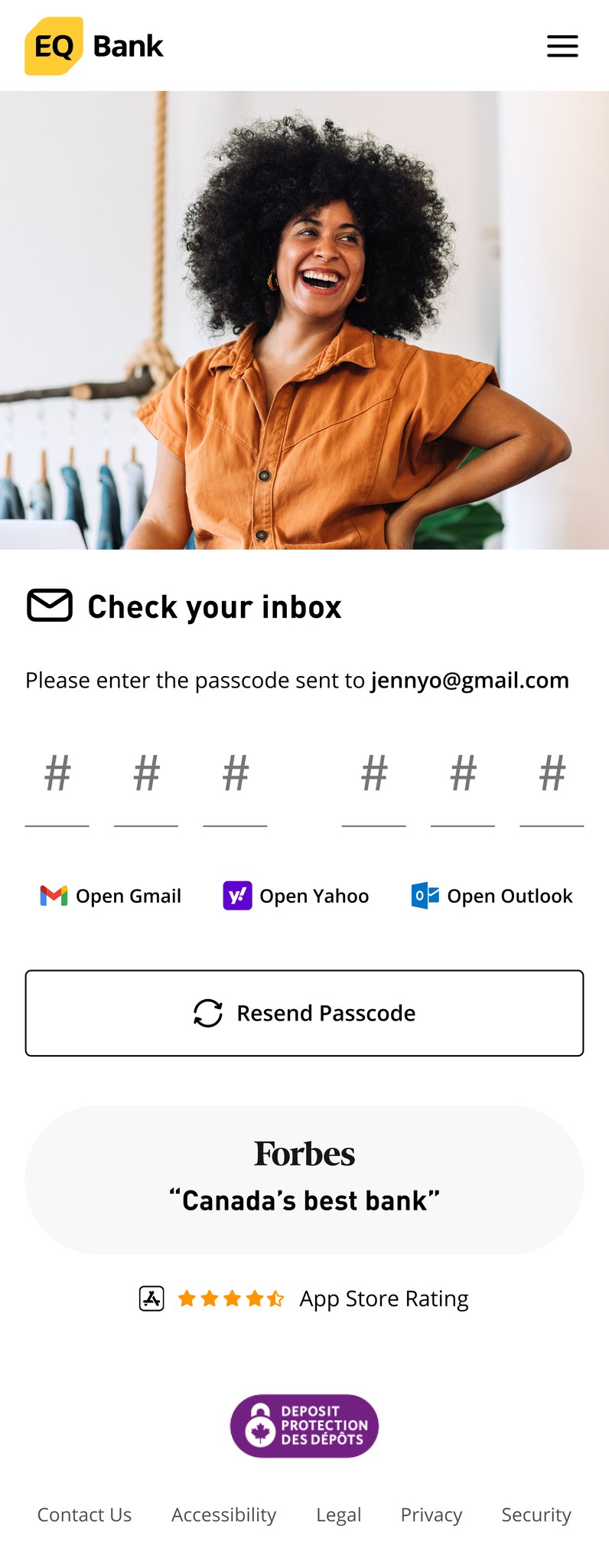

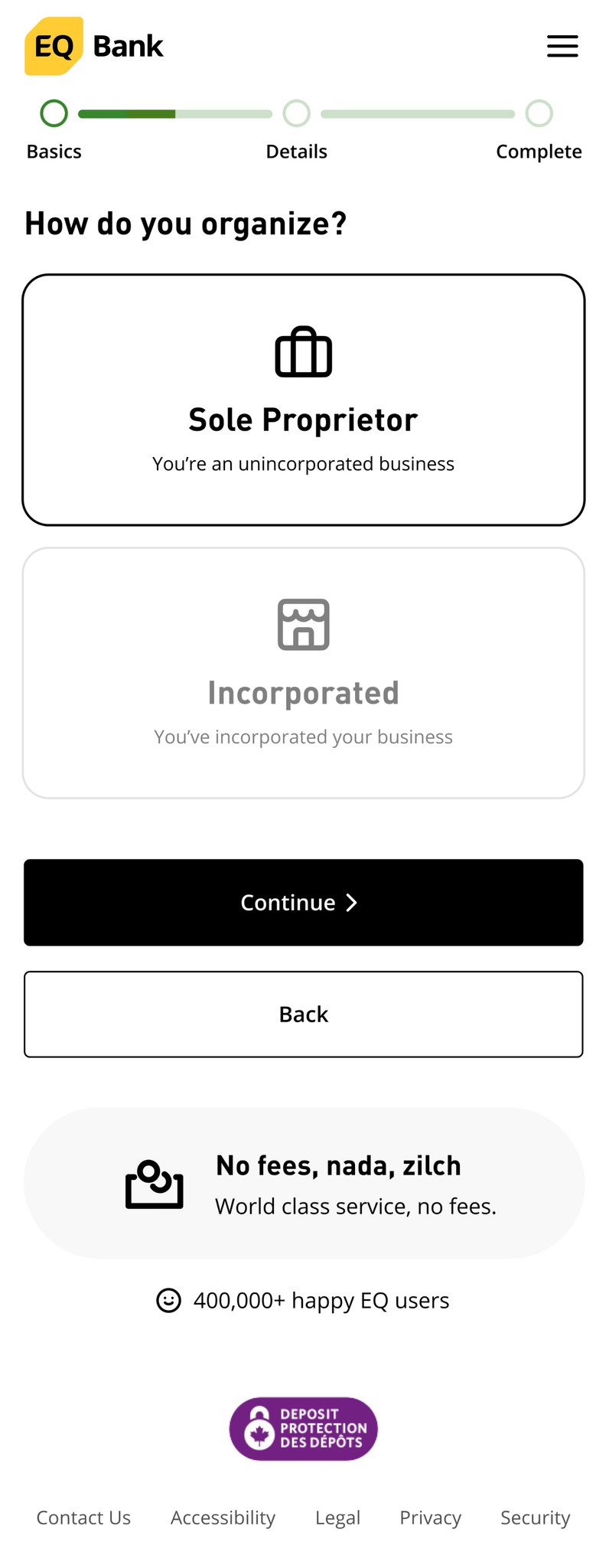

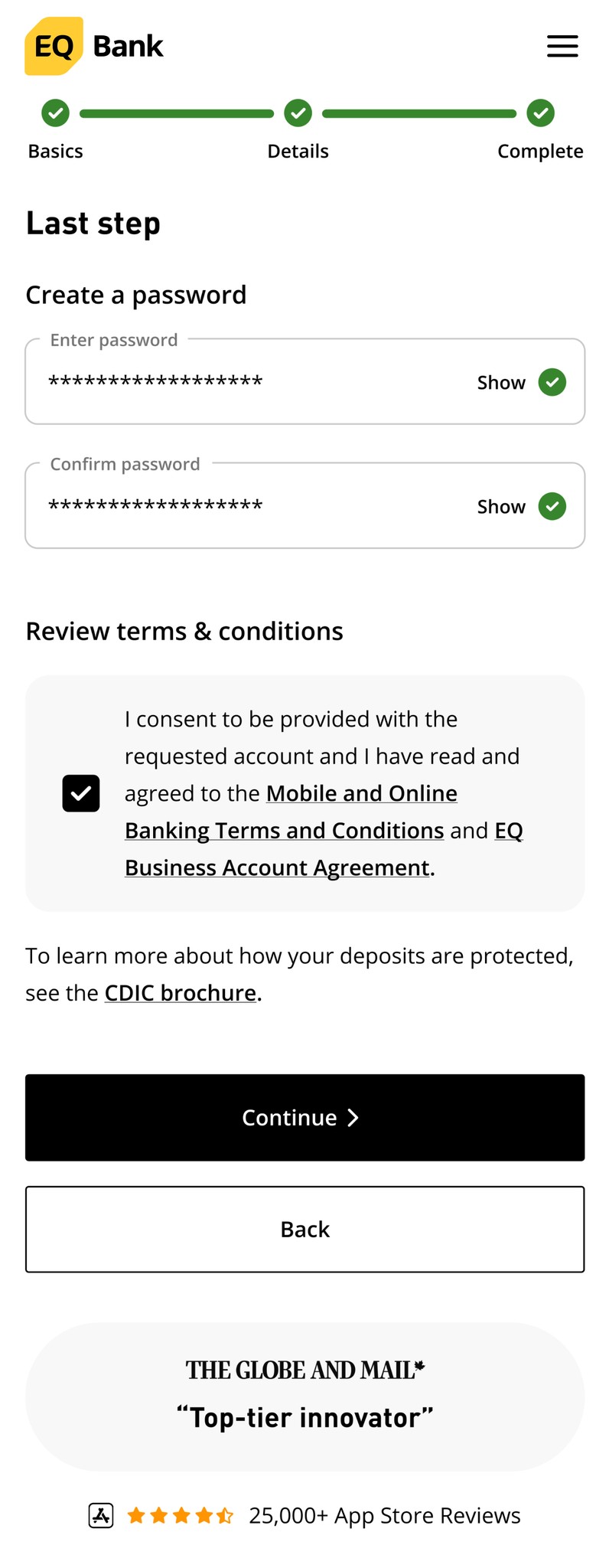

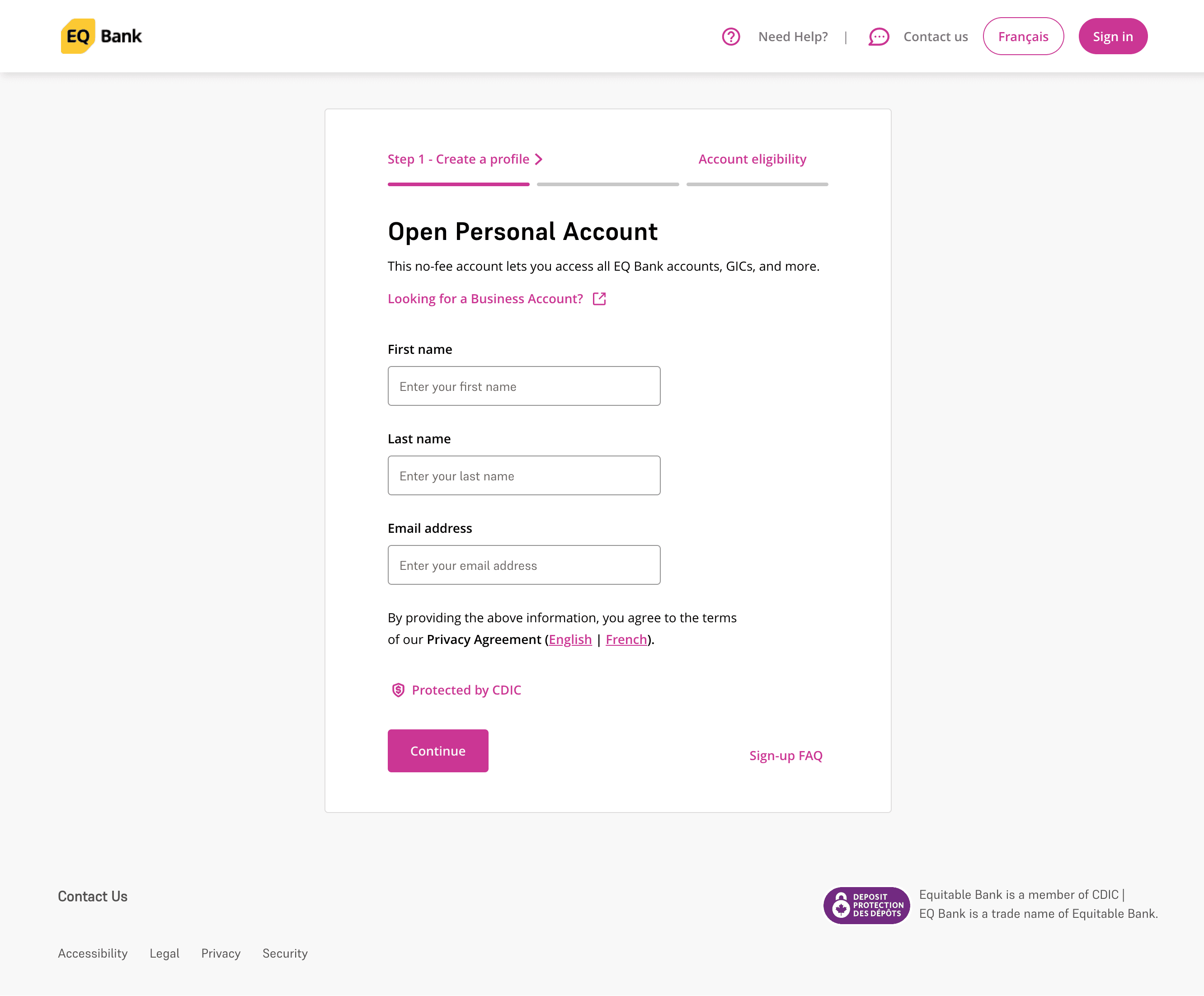

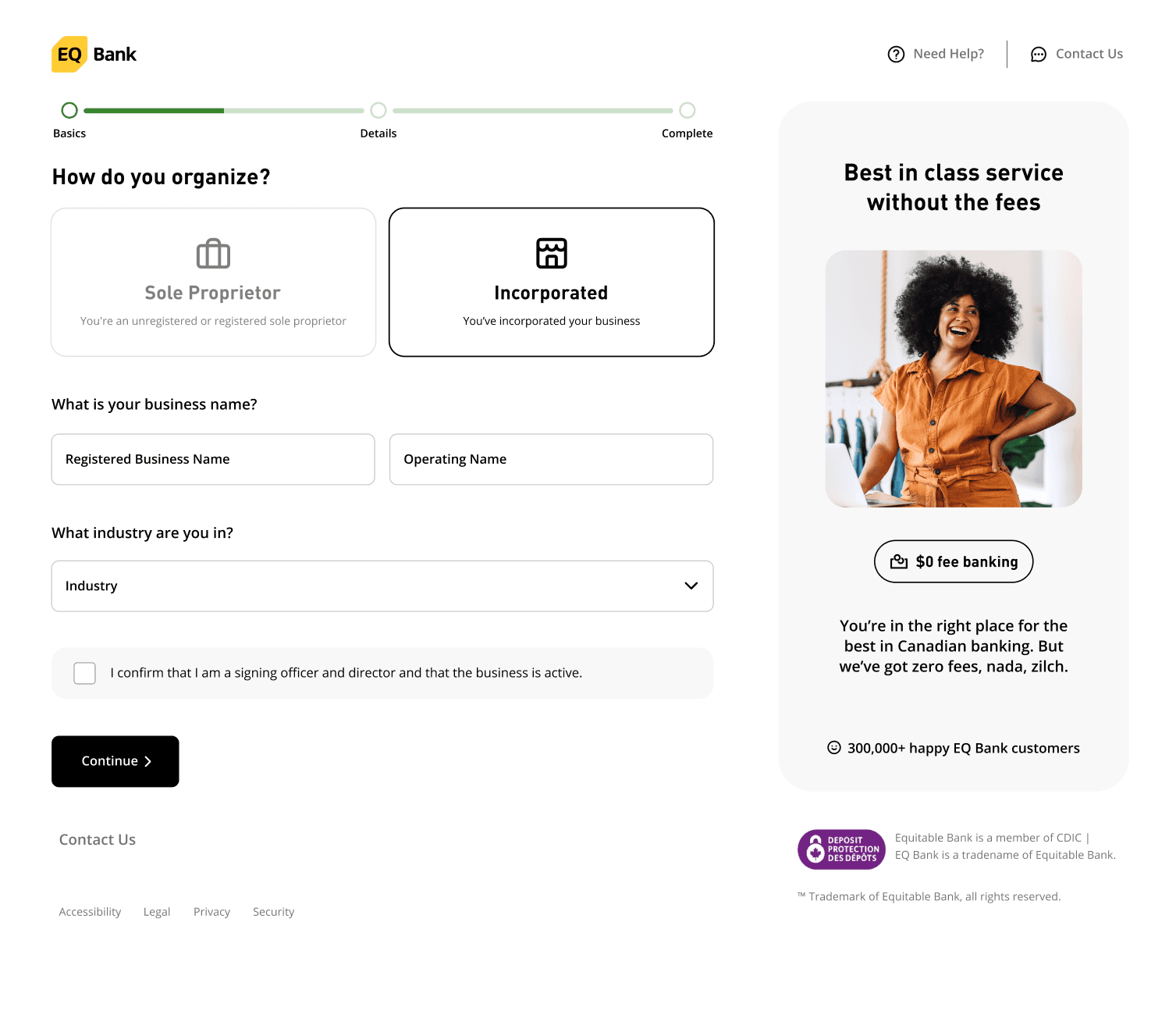

This project involved a complete overhaul of the onboarding process at EQ Bank, as the existing onboarding flow used for Personal Banking was unsuitable for the extensive user data required for business accounts.

The objective was to reduce friction, enhance user experience, and deliver measurable business outcomes for this new 0-to-1 venture in a highly regulated and competitive industry.